Casual hourly rate calculator

Subtract the daily value of the tax offsets from the amount found in step 1. The calculator will work out pay rates hourly and weekly penalty rates casual rates allowances shift work overtime and public holiday rates all based on the industry and.

How To Calculate Wages 14 Steps With Pictures Wikihow

Ignore cents input 193 into the Withholding.

. Enter the number of hours and the rate at which you will get paid. Average Casual Worker Hourly Pay 1503 hour Avg. Gross Annual Income of hours worked per week x.

There are two options. Ordinary Casual Hourly Rate. Different rates are used to calculate overtime and penalty rates for casuals.

Learn about workplace entitlements and obligations for sick and carers leave COVID-19 vaccinations PCR and rapid antigen testing and more. 60000 dollars a year is how much. Hourly Rate Calculator A free calculator to convert a salary between its hourly biweekly monthly and annual amounts.

Your salary - Superannuation is paid additionally by employer. Use our calculator to check your base pay rate and the weekend penalty rates youre entitled to whether youre a permanent or casual retail worker. In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work.

2 There are not other additional levies. The calculation on the Medicare levy assumes you are single with no dependants. 3 You are entitled to 25000 Low Income Tax Offset.

Overtime rates are calculated on the ordinary hourly rate. Take home pay 661k. The ordinary hourly rate is made up of.

To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of working hours per week. Base Hourly Rate USD 10 1129 MEDIAN 1503 90 1969 The average hourly pay for a Casual Worker is 1503 Hourly Rate. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be.

For example for 5 hours a month at time and a half enter 5 15. For example if a casual worker is paid the current national minimum wage of 2138 per hour and their Award or Enterprise Agreement stipulates a casual loading rate of 25 the calculation. Find out the benefit of that overtime.

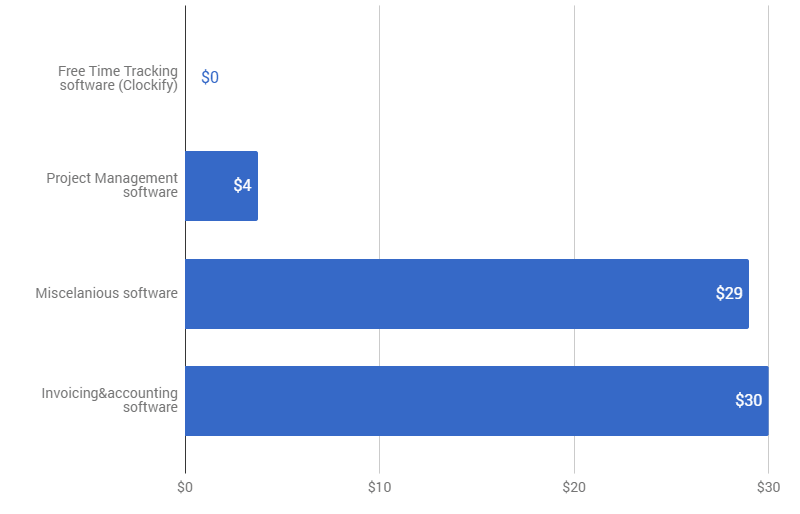

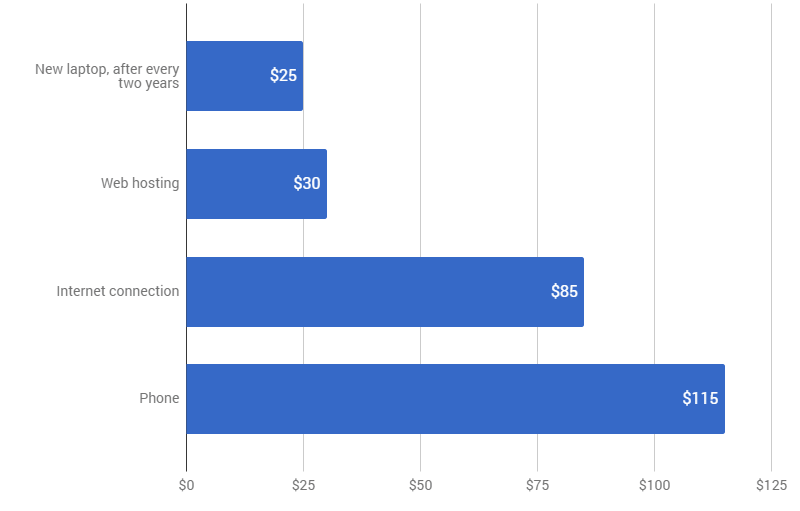

Hourly Rate Calculator For finding actual employee hourly rates Designed for business owners this hourly rate calculator estimates the actual cost per hour worked for an employee total. Under awards and agreements casual employees are also paid a casual loading a higher pay rate for being a casual employee or a specific pay rate for being a casual employee. There are two options.

An employee earns 19362 and claims tax offsets of 500.

Gst Calculator How To Find Out Goods And Service Tax Tax Refund

Hourly Rate Calculator

Markup Calculator Omni Calculator Sales People Omni

Hourly Rate Calculator

Hourly Rate Calculator

How To Calculate Wages 14 Steps With Pictures Wikihow

Salary To Hourly Paycheck Calculator Omni Salary Budget Saving Paycheck

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Contract Template

Hourly Rate Calculator

How To Calculate Wages 14 Steps With Pictures Wikihow

Employee Cost Calculator Updated 2022 Employee Cost Calculation

Overtime Calculator How To Calculate Time And A Half

Overtime Calculator

Real Hourly Wage Calculator Nerdy Humor Teacher Humor Work Humor

Hourly Rate Calculator

Check Target Hourly Rate Calculator Check

Overtime Calculator